RAK Offshore Company Formation Made Easy

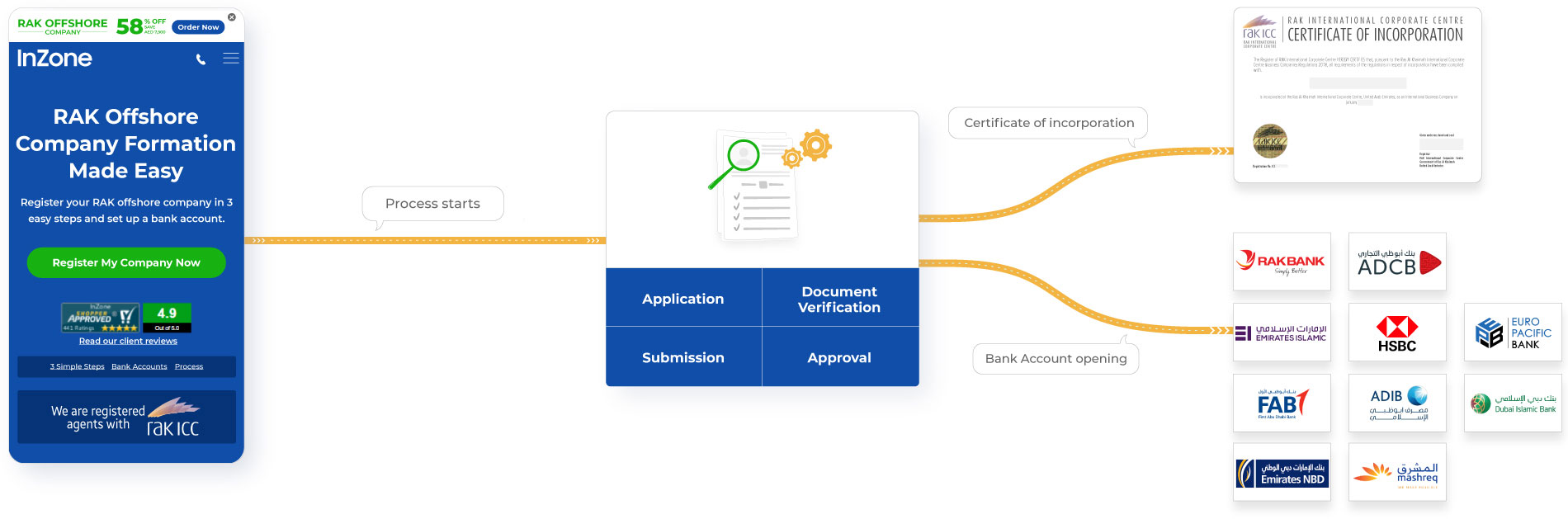

Register your RAK offshore company in 3 easy steps and set up a bank account.

About RAKICC and RAK Offshore

What is RAKICC & its role in an RAK offshore company formation?

RAK International Corporate Centre (also known as ‘RAKICC’ or ‘RAK ICC’) is a Government corporate registry in the Emirate of Ras Al Khaimah, United Arab Emirates. RAKICC carries out the registration and formation of international business companies/offshore companies in UAE and provides a full range of registration services in connection with the international business/offshore company activity.

RAKICC was created through Decree No. 12 of 2015 (amended by Decree No. 4 of 2016) which consolidated two (2) company registries known as RAK International Companies (previously part of RAK Free Trade Zone) and RAK Offshore (previously part of RAK Investment Authority).

RAKICC is known as a modern, world class offshore company registration office and complies with international best practices. RAKICC has developed a strong reputation and is considered to be one of the most respected brands for UAE offshore company registration.

What are the benefits of an RAK offshore company in UAE?

RAKICC companies enjoy the following benefits:

- You can open a bank account in the name of the RAK offshore company.

- You can own real properties in Ras Al Khaimah and Dubai through a RAK offshore company.

- RAK offshore company allows 100% foreign ownership.

- RAK offshore company can own shares in a mainland company or a free zone company in the United Arab Emirates.

- RAK offshore company offers Zero taxes.

- You can establish subsidiary with RAK Economic Zone.

- RAKICC offers state of the art legislation which is a cornerstone for any reliable offshore company set up jurisdiction.

- RAKICC has robust compliance procedures.

What is RAK offshore or RAK IBC?

RAK offshore or RAK IBC is usually used as synonym for an offshore company registered with RAKICC in the Emirate of Ras Al Khaimah. Before the consolidation of the corporate registry in 2016, RAK offshore existed as an independent as part of RAK Investment Authority.

What is the legislative framework for RAKICC?

The legislative framework for RAKICC includes (i) the RAKICC Business Companies Regulations 2016; and (ii) RAKICC Registered Agent Regulations 2016.

3 Simple Steps

Register your RAK Offshore Company in UAE in 3 Simple Steps

Pricing

Refer the below promotional packages for RAK offshore company formation costs. The packages are offered for a limited time.

- Government fee covered

- Certificate of incorporation

- Memorandum and Articles of Association

- Premium address in Dubai, Business Bay

- Resolution to appoint director(s)

- Dedicated agent for 1 year

*Yearly Fee from second year: AED 6,999 (govt. fee included)

Gold includes everything in Silver, plus:

- Assistance with bank account opening

- Share certificate(s) issued in the name of each of the share holders of the company

- Dedicated company secretarial services

*Yearly Fee from second year: AED 6,999 (govt. fee included)

Platinum includes everything in Gold, plus:

- Company stamp

- Company letterhead

- Assigned premier service agent throughout the year who will respond to you with priority

*Yearly Fee from second year: AED 6,999 (govt. fee included)

VIP includes everything in Platinum, plus:

- Fast-tracked application filing with RAK ICC

- 360° corporate banking assistance (including compliance profiling & customized applications for UAE and offshore banks)

- Exclusive multiple currency accounts with international debit and credit cards

- VIP personal bank account opening

*Yearly Fee from second year: AED 6,999 (govt. fee included)

We accept credit and debit card payments

*Offer is valid until 31 July 2025.

An amount of AED 500 applies for each corporate shareholder.

The above packages cover three (3) shareholders for a RAK ICC company. An amount of AED 500 shall be payable for each additional shareholder after the first three (3) shareholders.

The bank account will be opened based on the personal profile of the client and the company. The discretion to open a RAK offshore bank account vests solely with the respective bank.

Bank Accounts

We work closely with the following banks for opening bank accounts for our clients.

Top Jurisdiction

Process

Here is the process for RAK Offshore company formation and bank account opening.

Step 1 – We prepare your RAK Offshore company documents

We will reserve your RAK Offshore company name and prepare the following company formation documents as your RAK ICC registered agents:

- Memorandum of association.

- Articles of association.

- Letter of appointment of director(s) and secretary.

- Letter of appointment of registered agent.

Step 2 – You sign your RAK Offshore company documents

For UAE residents: You will need to visit our offices in Business Bay, Dubai, United Arab Emirates, to sign your company documents.

For non-UAE residents: We will prepare a specimen signature form which you will need to sign before a notary public in the country of your residence and return in original to us. All other company documents will need to be printed and signed by you at your office/home and returned to us in originals.

Step 3 – We will complete your RAK Offshore company registration

Regular requests: We will submit your company documents for your RAK Offshore company formation. The prescribed timeframe for RAK Offshore company registration is approximately three (3) working days.

Urgent requests: If you require urgent service, your RAK Offshore company formation can be completed in one (1) working day with an additional fee of AED 1,700.

Your RAK Offshore Company Bank Account

Once your RAK ICC company registration has been completed, you can open a bank account with any bank offering bank account opening services to UAE offshore companies as well as offshore companies around the world. We work closely with major banks in the UAE and worldwide. We will provide all coordination and facilitation required for the bank account opening, if you have opted for this service. The process of RAK Offshore bank account opening may take between 5-15 working days or more depending on a case by case basis.

Ultimate Beneficial Owner (UBO) Declaration for RAK Offshore Companies

The Government of UAE released Cabinet Decision No. (58) of 2020 on 24 August 2020 regarding the beneficial owner procedures (“Cabinet Decision”), which applies to RAK offshore companies. The Cabinet Decision mandates that offshore companies have to declare the information about Ultimate Beneficial Owners (“UBOs”) to the relevant licensing authority. This means that RAK offshore companies have to disclose UBO details to the Ras-Al-Khaimah International Corporate Centre (RAK ICC).

If your RAK ICC company does not file UBO information, then the company owners can invite penalties of up to AED 100,000. Considering this backdrop, it has become essential to answer the burning questions related to UBO declarations. In this article, we have attempted to answer the key questions about UBO declarations:

1. Who is a UBO?

Any individual that ultimately benefits from a company is a UBO. A UBO is an individual that has ultimate control over a business. A UBO for a RAK offshore company is identified after considering certain factors. By definition, UBOs are persons who ultimately own or control the company. The control can be exercised by holding shares or voting rights. As per the Cabinet Decision, a UBO is any individual having minimum 25% shareholding of the company (whether through direct or indirect ownership), along with voting rights. UBOs can also appoint or dismiss directors / managers.

So, what all does the UBO declaration consist of? A declaration made by a RAK offshore company for its UBO includes generally the names of directors / managers acting in accordance with the instructions of another person. The declaration also includes the information about partners and shareholders to the extent of their voting rights and the date they acquired ownership of the RAK ICC company.

2. Who should declare UBOs?

All companies in UAE must declare their UBO information. It does not matter if the company is registered with the mainland, free zone or offshores. RAK offshore companies have to timely disclose the details of their UBOs, even though they are registered in UAE but operate outside of UAE.

3. Where to file UBO details?

Each type of company has a different authority with which they are required to submit UBO details. This is because companies in UAE are differentiated on the basis of their registration with the mainland, free zones or offshores. Any UAE offshore company has to declare the information of the UBO to the offshore registration authority that has issued the license of the company. The licensing authority for UBO declaration for companies registered in Ras Al Khaimah is the RAK ICC.

Various deadlines are issued by the Government of UAE and RAK ICC for filing and updating the details of UBOs for RAK offshore companies. It is very important that RAK ICC companies file their UBO details with the given deadlines. This will help your offshore company avoid penalties.

4. What to include in the UBO declaration?

The below mentioned UBO details should be disclosed to RAK ICC by RAK offshore companies:

- Identification details of the UBO. This includes – name, nationality, date, place of birth and address.

- Details of identity card, the country of issuance, date of issuance, and date of expiry.

- Date and basis on which a person became the UBO.

- Date on which a person ceased to be the UBO, if applicable.

Any amendment in the information of a RAK offshore company’s UBO, shareholders, or directors must be notified to RAK ICC within fifteen (15) days of the said change.

5. How vital is UBO disclosure?

The Government of UAE released the Cabinet Decision to bring transparency and accountability in business transactions in UAE by developing dependable procedures in respect to beneficial owner data.

The Government of UAE issued the Cabinet Decision to avoid financial crimes in UAE. One example of financial crime is money laundering. Money laundering takes place through formation of shell companies, wherein these companies attempt to conceal the names of the people gaining ultimate benefits. To fight this, UBO declaration is vital for any economy to examine a flow of legitimate money. Shortcoming in screening of UBOs can put at risk violation of local UAE laws and can also damage the UAE economy.

6. What are the penalties?

RAK offshore companies can be penalised by the Ministry of Economy, UAE if they do not declare UBO details within the prescribed deadlines. The punishment depends on the number of times a company commits a particular violation. A written warning is presented if it is the first time. After the second time, fines are imposed on a company. Upon the third and final occurrence, the Government of UAE may not only impose fines but also temporarily suspend the license of the RAK Offshore company.

Some examples of the penalties are given here:

- If the company does not maintain a register of UBO data – fines up to AED 100,000 and suspension of the trade license for at least twelve (12) months.

- If the company does not maintain a register of partners / shareholders – fines up to AED 100,000 and suspension of the trade license for at least twelve (12) months.

- If the company fails to provide additional information requested by the registrar – fines up to AED 10,000 and suspension of the trade license for at least one (1) month.

Many other violations regarding details of shareholders, liquidators, filing and much more are given in the Cabinet Decision. Therefore, all companies must follow the governmental regulations, and timely file UBO declarations.

7. How can InZone help?

InZone assists in company formation and compliances of RAK ICC companies. InZone’s lawyers specialise in laws concerning UBO declarations. We can help companies timely file their UBO data. Feel free to contact us for your RAK ICC company’s UBO filing.

Benefits of UAE Economic Substance Regulations for RAK Offshore Companies

The UAE is one of the few offshore jurisdictions that have implemented the Economic Substance requirements of the Organization for Economic Co-operation and Development (OECD) and the European Union Code of Conduct Group on Business Taxation. The introduction of the Economic Substance Regulations (ESR) in the UAE means that the country is now fully compliant with the international tax commitments on tax cooperation. The result of this compliance is that the UAE is now one of the very few offshore jurisdictions named on the ‘whitelist’ of the European Union.

According to the UAE Cabinet of Ministers Resolution No. 31 that implemented the ESR, all business established in the UAE (including the offshore companies) that conduct any Relevant Activities (listed below) will fall within the scope of the ESR. This means that these businesses will be required to maintain a certain economic presence in the UAE in connection with the activities undertaken by them.

What are Relevant Activities under ESR?

The Relevant Activities that fall within the scope of the ESR are:

- Banking Business

- Insurance Business

- Investment Fund management Business

- Lease – Finance Business

- Headquarters Business

- Shipping Business

- Holding Company Business

- Intellectual property Business (“IP”)

- Distribution and Service Centre Business

No impact on businesses ‘not’ carrying out Relevant Activities

Any businesses that do not carry out any of the Relevant Activities are not required to maintain any economic substance in the UAE. These businesses are outside the scope of the ESR. They can carry on their operations without the requirement to file any economic substance returns to the RAK ICC.

RAK offshore companies gaining more popularity

As a result of the implementation of the ESR in the UAE, RAK ICC has emerged as one of the most sought-after offshore jurisdictions in the world for the formation of offshore companies.

RAK ICC is well positioned to provide all necessary support and infrastructure to the offshore companies registered with it to enable them to meet the economic substance requirements. These mechanisms include setting up subsidiaries through RAKEZ free zone (through premium product of the RAK ICC), opening branch offices and using outsourcing solutions.

The developments on ESR have also resulted in a number of companies registered in other offshore jurisdictions migrating to RAK ICC. Everchanging shareholder priorities have ensured a strong shift from other offshore centres to RAK ICC. As part of this redomiciliation, companies maintain their existing legal status along with their operational and banking history. This is also seen as one of the best means to meet their ESR requirements.

The introduction of ESR provides a strong platform to RAK ICC to attract more shareholders from other jurisdictions in a country that has substance and is cost-effective.

Which jurisdictions are on EU blacklist?

According to the revision released on 27 February 2020, the following jurisdictions are on the blacklist of the EU as being non-cooperative jurisdictions:

- American Samoa

- Cayman Islands

- Fiji

- Guam

- Oman

- Palau

- Panama

- Samoa

- Seychelles

- S. Virgin Islands

- Vanuatu

Accordingly, RAK ICC has a significant competitive advantage as an offshore corporate registry due to its compliance with international standards and being located in the UAE which is fully compliant with the economic substance requirements of the EU and OECD.

How we can help you?

We assist our clients in:

- Determining whether the company in question is in scope of the ESR

- Identifying risks of non-compliance

- Filing the ESR notifications

- Meeting the economic substance test

- Filing ESR returns

COVID-19 Update: Order and Register RAK Offshore Company from Home

Given the Covid-19 situation, RAK ICC has changed its procedures to allow RAK offshore company registration without having the original signed company documents to be submitted.

Earlier, shareholders and directors residing outside the UAE were required to send us originals of the following documents by courier:

- Memorandum and articles of association.

- Director consent letter.

- Agent appointment letter.

- Duly notarised specimen signatures of shareholders and directors.

The entire process of RAK Offshore company formation can thus be completed in the comfort of your home.

The above process is now applicable to all shareholders and directors regardless of their residence (i.e. inside or outside the UAE).

RAK ICC has ensured to maintain high standards of service during the current situation. The overall process for the completion of RAK Offshore company formation should require less time as we would not require the original company documents to be couriered to us by you.

We are offering a minimum discount of AED 7,000 on RAK ICC company formation packages during this time.

Key Features

Here are some of the key features of RAK offshore companies

| RAK ICC | RAK International Corporate Centre (RAK ICC or RAKICC) is a Corporate Registry established in the Emirate of Ras Al Khaimah, United Arab Emirates. |

| Type of Company | International business company that can carry out business internationally or act as a holding company. |

| Information publishing and confidentiality | RAK ICC does not keep any public register relating to company shareholders or officers. This information is kept confidential in accordance with the applicable laws. |

| Requirements for accounting | There are no accounting or reporting requirements for RAK offshore companies. |

| Taxes | RAK offshore companies are exempt from all taxation in the United Arab Emirates. |

| Laws | RAK ICC provides a modern offshore legislative framework. Basis of legislation is the UAE law. |

| 100% Ownership | 100% foreign ownership is permitted and there are no requirements for having UAE national as partner. |

| Time zone | Convenient world time zone: GMT+4 |

| Paid up capital requirement | No paid up capital requirement. |

| Minimum directors/shareholders | RAK offshore company requires a minimum of 1 director and 1 shareholder. |

| Bearer shares | Not permitted. |

Frequently Asked Questions

Here are some answers to some of the most common questions related to RAK offshore companies.

- Company Limited by Shares – most commonly used.

- Company Limited by Guarantee

- Restricted Purposes Company

- Segregated Portfolio Company

- Unlimited Company

- the amount that he/she has agreed to liable to contribute in memorandum and articles of association

- any other liability expressly provided for in memorandum or articles of association

Ownership of Real Estate in Dubai with an RAK Offshore Company

RAK International Corporate Centre (also known as RAKICC) and the Dubai Land Department have signed an MOU in July 2019 to permit those who own an offshore company in RAK (also known as RAK IBC companies) to directly own real estate in the Emirate of Dubai. This was not previously possible and for anyone intending to own real estate in Dubai, the only available option was to set up an offshore company in Dubai.

This arrangement has been welcomed as a landmark development since the vast majority of people looking to set up an offshore company in Dubai with the intention to hold real estate there can now so at a comparatively cheaper RAK offshore company cost. The difference between Dubai offshore company formation cost and RAK offshore company formation cost is almost AED 9,000 – in favour of RAK offshore. This is a significant difference when compared in the context of the costs that are typically applicable to the incorporation of offshore companies around the world.

The Emirate of Dubai offers more than 23 freehold areas where any foreign national, RAK offshore or Jebel Ali offshore companies can own real estate properties. The most well-known freehold areas in Dubai include Business Bay, Dubai Marina, Downtown Dubai, Palm Jumeirah, Jumeirah Lake Towers, Emirates Hills, Springs, Meadows, Arabian Ranches and Jumeirah Village Circle.

RAK ICC issues no-objection certificates for companies that wish to own real estate in Dubai. The no-objection certificate is required to be presented to Dubai Land Department in order to transfer the property to the offshore company.

With InZone’s world-class company formation services, our clients are now taking advantage of this opportunity to own real estate in Dubai by setting up a RAK offshore company rather than owning an offshore company in Dubai.

Why is RAK ICC the Best Offshore Jurisdiction in the World?

There are several offshore jurisdictions around the world offering offshore and international business company formations. These jurisdictions range from full offshore to mid-shore jurisdictions.

Investors are increasingly concerned about the risks associated with the choice of jurisdiction for their offshore company formation. They are usually looking for the most effective structures for carrying out international business transactions and for holding their assets keeping in view the ease of doing business, jurisdiction stability, tax optimization and bank account opening.

Selecting the right offshore jurisdiction has thus become a key to any of the offshore structures considered by the investors.

We have analyzed twenty-one (21) offshore jurisdictions around the world keeping in view the key parameters including ease of doing business, jurisdiction stability, taxation and corporate bank account opening to determine the best offshore jurisdiction in the world.

The twenty-one (21) offshore jurisdictions considered by us for this study can be categorized in six (6) clusters as below:

| Middle East | Caribbean | Europe | Asia | Central America | USA | Africa |

| RAK ICC | BVI | Cyprus | Hong Kong | Panama | Florida | Seychelles |

| Jebel Ali | Cayman Islands | Gibraltar | Singapore | Belize | Delaware | Mauritius |

| Ajman | Bahamas | Malta | Costa Rica | Wyoming | ||

| United Kingdom | New York |

| Middle East |

| RAK ICC |

| Jebel Ali |

| Ajman |

| Caribbean |

| BVI |

| Cayman Islands |

| Bahamas |

| Europe |

| Cyprus |

| Gibraltar |

| Malta |

| United Kingdom |

| Asia |

| Hong Kong |

| Singapore |

| Central America |

| Panama |

| Belize |

| Costa Rica |

| USA |

| Florida |

| Delaware |

| Wyoming |

| New York |

| Africa |

| Seychelles |

| Mauritius |

There have been substantial changes in the reputation and the infrastructure used by the above offshore jurisdictions in the recent past. This has resulted in some of the jurisdictions gaining more popularity and the others losing track and as a result losing clients to the other offshore jurisdictions. The factors involved in these changes include globalization and the requirement of cost and tax efficient company structures in order to carry out international business transactions and to hold assets.

Based on our analysis, Ras Al Khaimah offshore has proven to the best offshore company formation jurisdiction in the world due to the following key factors working in its favour:

1. Ease of doing business

RAK ICC is a corporate registry in Ras Al Khaimah which is one of the key Emirates in the UAE. The UAE is a leading jurisdiction and ranks:

- No. 1 on ease of doing business index-Mena Region.

- No. 11 in the world bank’s annual ease of doing business ranking.

- No. 2 in the world government trust index.

- No. 27 amongst 140 countries in the global competitiveness ranking (highest in the region: higher than Malta (36), Cyprus (44), Mauritius (49), Panama (64) and Seychelles (74). Only Hong Kong has the same rating within other offshore jurisdictions.

RAK ICC offers one of the easiest offshore company formation processes in the world. It offers simple registration process with international corporate features and availability of various company structures.

RAK ICC has a premium product with which it offers the incorporation of free zone companies in partnership with the Ras Al Khaimah Economic Zone (RAKEZ). This option provides the shareholders flexibility to operate their business inside the UAE and obtain UAE residency visa. RAKEZ also offers zero corporate and individual taxes which makes the larger proposition highly attractive to anyone looking to have an offshore structure along with their ability to carry out business in the UAE.

Other common features of setting-up a UAE offshore company with RAK ICC include the following:

- 100% foreign ownership for any nationality.

- One day incorporation process.

- No restrictions on number of shareholders for company formation.

- Corporate directors are permitted.

- No office requirements.

- No attestation required for corporate documents.

- Cost efficient registration and renewal fees.

- No requirement to file financial accounts.

- No requirement for minimum capital.

- Constitutional documents can be issued in dual languages.

The registry offers state-of-the-art portal for the incorporation and on-going maintenance of the companies registered with it.

2. Jurisdiction Stability

RAK ICC has an outstanding reputation as a corporate registry that operates in full compliance with international standards and best practices.

The credit rating for the UAE is:

- Double A for S&P.

- Double A2 for Moody’s.

The UAE:

- Ranks No. 8 largest oil producer in the world.

- Has per capita USD 40,000 GDP (same as Germany).

- Ranks No. 2 in the world in terms of avoidance of double taxation agreements and No.1 among the Arab nations.

Investment protection is offered through numerous bilateral investments treaties (BITS) which is another added value the country offers.

The jurisdiction offers swifter and more efficient resolutions to court proceedings with easy processes. It offers to choose from the English law courts at Dubai International Financial Centre (DIFC) and Abu Dhabi Global Markets (ADGM) for the resolution of any disputes.

DIFC Wills are registered and enforced for asset protection and succession planning for non-Muslim shareholders.

Other common features include the following:

- Variety of legal structures and different products available for different usages.

- No restriction on capital repatriation.

- Migration or continuance of existing corporate entities from various jurisdictions.

- Different classes of shares and the ability to register the share pledge.

- USD freely available. Local currency pegged to USD.

3. Double Taxation Treaties

The UAE has signed 210 tax agreements (including 123 agreements to avoid double taxation and 87 agreements to protect and promote investment). As a result, RAK ICC has access to a large double taxation treaties (DTT) network including a wide range of bi-lateral investment treaties.

The UAE signed a three-year (2019-2021) extension of the MoU between the UAE and the Organization for Economic Cooperation and Development (OECD) in March 2019.

4. Bank Accounts and other Financing Structures

The UAE has a mature banking system with over 50 national and international banks. RAK offshore companies can open bank accounts locally and internationally with various banks.

RAK ICC also offers corporate vehicles with several attractive features including the securitization and isolation of financial and legal risks by ring-fencing assets and liabilities. Special purpose vehicles can be established as subsidiaries. Project or joint venture vehicles can be established to ensure that only assets related to a transaction are exposed to the liabilities associated with that transaction.

RAK has an overall strong infrastructure, a mature banking network, political stability, tax advantages and ranks at the top for ease of doing business compared with other offshore jurisdictions. For these reasons, RAK ICC can be argued as the best offshore jurisdiction in the world.

Read More Articles About RAK Offshore Companies

5 Key Reasons for Choosing RAK ICC for IBCs

4 Key Differences Between Offshore and Free Zone Companies in UAE

Wills and Estate Planning for RAK Offshore Companies

Types of RAK Offshore Companies

RAK ICC offers various types of offshore companies to suit the needs to shareholders and investors. The companies range from standard offshore/international business companies to specific purpose vehicles which are outlined below:

1. Standard Offshore Companies or IBCs

An offshore company or international business company (IBC) is the most-commonly used form of offshore company in the UAE. It is a standard company that allows the shareholders to carry out international business transactions around the world. Typical international business activities carried out by these companies include:

- Various types of services.

- Consultancy.

- Trading.

- Holding of shares or listed securities.

- Holding of assets such as trademarks and other IP.

- Holding of real estate in Dubai and elsewhere.

Shareholders in these companies are typically individuals who wish to take advantage of freedom offered by these companies, associated tax benefits and bank account opening facility offered by various banks in the UAE and around the world. These companies are also used by shareholders as part of their estate planning.

2. Special Purpose Vehicles (SPVs)

SPVs are corporate vehicles established for various purposes including:

- Structured finance transactions.

- Securitizations.

- Asset holding and transfers.

- Financing and raising capital.

- Ring-fencing legal and financial risks.

- Fractional ownerships.

SPVs are typically incorporated as subsidiaries, project or joint venture companies and ensure that only the transaction specific assets are exposed to liabilities related to the transaction. The key feature of an SPV is that it is a separate legal entity and any claims by the creditors cannot be extended to the assets of the shareholders or any of its sister companies of the SPV.

In a typical SPV structure, the parent company or the investor sets-up the SPV. The SPV holds the relevant security asset and enters into a loan agreement and share pledge agreement with the lender. The financing is provided to the operating company and only the assets of the SPV remain open to a claim by the lender.

3. Intellectual Property Holding Companies

The intellectual property (IP) related to a business name or a system are typically the most valuable assets of a business. Businesses that intend to have national or international identity take steps to protect the use of their name, logo or other IP including trademarks, patents and designs, franchises, know-how and copyrights.

IP holding companies are usually established to obtain the following benefits:

- Centralization of all IP assets.

- IP protection.

- Taxation.

- Securitization of IP.

- Clear balance sheet for the group.

In a typical RAK ICC IP holding offshore company structure, a parent company establishes an IP holding company and transfers all its IP assets into the name of that company. IP holding company thus holds all the IP assets for the group. IP holding company then enters into appropriate license or franchise agreements with subsidiaries of the holding company or any other parties who may wish to use the IP rights. Ring-fencing of IP assets is also achieved through this method.

4. Private Client Solution

This type of entity is established as a family office by a wealthy family to manage its wealth. A family typically uses these entities to provide family members certain services including tax and estate planning. The family offices may also include philanthropic arms for supporting charitable, social and educational interests of the families.

Typical benefits of these types of entities include:

- Foundation can be shareholder.

- Estate planning.

- Tax benefits.

- Asset protection.

- DIFC Will – only applicable to non-Muslims.

In a typical family office offshore company structure, a family beneficiary sets-up a foundation with RAK ICC. The foundation then sets-up a family office SPV with RAK ICC. Family office SPV then owns various assets including real estate, shares in listed companies and other operating companies.

5. Segregated Portfolio Company (SPC)

An SPC is also sometimes referred to as a protected cell company. It segregates assets and liabilities of different classes of shares from each other as well as from the general assets of the SPC. It is a complicated structure used in sophisticated transactions. Segregated portfolio assets comprise assets representing share capital, capital reserves, retained earnings, share premiums and all other assets of the SPC.

The main benefits of SPC include:

- Separate legal personality with limited liability.

- Cover up to ten (10) segregated portfolios.

- Separation of liability between share classes and general assets of SPC.

- Sub bank accounts

6. Holding Companies

The holding company is typically incorporated to ring fence investments, public and private equity stakes and other assets.

In this structure, a parent company or investor sets-up a RAK ICC passive holding offshore company which owns the following types of assets:

- Publicly traded shares or bonds.

- Controlling or non-controlling share in UAE based companies or companies outside the UAE.

Main benefits of this type of entity include:

- Provides an effective structure for ease of ownership transfer.

- Security for finance-based valuation based on the underlying assets.

- Operating structure for bringing assets in one pool for reporting or management purposes.

InZone is a registered agent with RAK ICC and helps its clients choose the right structure for their RAK ICC company and provides end-to-end service for the incorporation and management of these entities.

Possible Structures of RAK ICC Foundation with RAK Offshore Company

RAK ICC Foundations have been launched in 2019 by the RAK ICC to offer a comprehensive framework for investors looking to protect and manage their wealth in the UAE and around the world. The legal framework for these Foundations is provided in RAK ICC Foundations Regulations 2019.

At a basic level, a Foundation is a legal entity established with the RAK ICC that provides an option to the investor to achieve various wealth distribution structures including estate planning and asset protection. The Founder establishes a Foundation to hold assets for the benefit of the qualified recipient.

A Foundation is quite similar to a Trust, a concept that is commonly used in common law jurisdictions. The fundamental difference between a Foundation and a Trust is that the Foundation is incorporated as a legal entity. Foundation thus has a distinct legal personality that separates liability while allowing full control of assets.

A Foundation also has a perpetual existence that continues to operate even after the death of the Founder. The Council of Members or the Guardian (as per their appointment) continue to operate the Foundation for the benefit of the qualified recipient. A qualified recipient in a Foundation is similar to a beneficiary appointed in a Trust.

Here are some of the possible structures of RAK ICC Foundations with RAK offshore companies:

Shares of RAK Offshore Company

A Foundation can be established by the Founder to own shares of a RAK offshore company. The offshore company based in the UAE can then in turn either own other assets around the world. The offshore company can undertake any business activities outside the UAE. Under this structure, any dividends of the offshore company flow back to the Foundation and are distributed to the qualified recipient.

Real Estate Assets

RAK ICC Foundations are not permitted to directly own real estate properties. However, the Founder can set up a RAK offshore company as a wholly owned company of the Foundation. The offshore company can then in turn own real estate properties either in the Emirate of Dubai or Ras Al Khaimah. The income of the real estate properties continues to flow to the qualified beneficiary through the offshore company.

Bank Accounts

Bank accounts can be set up in the name of RAK ICC Foundations where the funds can be kept by the Founder. The funds can be applied for the benefit of the qualified recipient.

Estate Planning

RAK ICC Foundations can be used as an effective tool for estate planning by the investors. The Council of Members can control the decision making in relation to the assets owned by the Foundation. These assets may either by owned by the Foundation directly or through a RAK offshore company. The assets can also be sold or otherwise managed in the best interests of the qualified recipient.

The above structures are the most common structures used for the RAK ICC Foundations. However, Foundations can also be used in a variety of other ways to ensure that the objectives set out in the Foundation charter are met.

InZone establishes RAK ICC Foundations and provides comprehensive advice to its clients around the world on the available structures.

RAK Offshore Company Bank Accounts

Corporate bank accounts for a RAK offshore company act as catalysts for the operation of RAK offshore companies in multiple ways. RAK offshore bank accounts ensure smooth financial mechanisms between the company and its clients for international transactions with 100% tax efficiency.

There are several banks located inside and outside of the UAE offering corporate offshore accounts, which makes business owners spoilt for choices. However, our expert advice on the most appropriate and suitable RAK offshore bank accounts to help your business thrive. Therefore, it is important to avail the services of a bank that is most suitable to your business needs.

We understand that several considerations go into choosing the right RAK offshore bank account, and that finalising a bank account depends on your business and financial goals. We are also aware that the requirements and processes for opening a bank account for your RAK offshore company can get tedious and overwhelming.

To help you choose a suitable corporate bank account for your RAK offshore company, we have summarised below the requirements for opening an offshore account with various UAE and international banks:

| UAE BANKS | ||||

| Bank | Minimum balance options | Monthly charges* | Estimated time for set up** | Denomination of currency |

| ADCB | AED 10,000 AED 50,000 AED 100,000 | AED 150* AED 200* AED 300* | 2 weeks | AED, USD |

| Abu Dhabi Islamic Bank | AED 100,000 AED 500,000 | AED 150* AED 50* | 2- 3 weeks | AED, USD, GBP, EUR |

| Ajman Bank | AED 25,000 | AED 100* | 1- 4 weeks | AED, USD |

| Banque Misr | AED 500,000 | AED 500* | 1-3 weeks | AED, USD, GBP, EUR |

| Dubai Islamic Bank | AED 50,000 | AED 150* | 1- 4 weeks | AED, USD, EUR |

| Ebury (It is not a bank but a financial services company) | AED 0 | AED 0 (One time set up fee of AED 8,500) | 3 weeks | 35 currencies |

| Emirates Islamic | AED 250,000 | AED 420* | 2-3 weeks | AED, USD, GBP |

| Emirates NBD | AED 500,000 | AED 500* | 3-4 weeks | AED, USD, EUR, GBP, HKD, CAD |

| First Abu Dhabi Bank | AED 10,000 AED 50,000 AED 250,000 AED 500,000 | AED 250* AED 250* AED 250* AED 500* | 1-3 weeks | AED, USD, GBP, EUR |

| Mashreq Bank | AED 25,000 AED 50,000 | AED 135 AED 135 | 2-3 weeks | AED, USD, EUR |

| RAK Bank | AED 25,000 AED 65,000 AED 500,000 | – – – | 3 weeks | AED, EUR, USD, GBP |

| Samba | AED 100,000 | AED 500* | 2 weeks | AED, USD, EUR, GBP |

Documents required for opening an offshore bank account with a UAE bank:

The following documents are generally required to open an offshore bank account with a UAE bank:

- Passport of shareholder(s) and director(s)

- Certificate of incorporation of the company

- Memorandum of association and articles of association with amendments (if any).

- Board resolution

- Power of attorney (if any)

- Share certificates

- Three (3) months utility bills

- Emirates ID and visa (applicable for the UAE residents)

- UAE entry stamp for non-residents

- Proof of address

The above list is only indicative. Additional documents may be required by specific banks on a case-to-case basis to assess the profile of the client.

International banks offering RAK offshore company bank accounts:

| INTERNATIONAL BANKS | ||||

| Bank | Minimum balance | Monthly charges* | Estimated time for set up** | Denomination of currency |

| Bank One (Mauritius) | AED 92,000 | AED 366 | 6 weeks | USD, GBP, EUR, AED, INR, CHF, CAD, AUD, JPY, KES (Kenya), SGD, Rand, RMB, MGA (Madagascar) |

| Caye International (Belize) | AED 36,000 | AED 50* | 2 weeks | USD, CAD, GBP, EUR, CHF |

| Nevis International (St. Kitts and Nevis) | 0 | 0 | 2 weeks | USD, EUR, GBP, AUD, CAD, CHF, JPY, SGD, HKD |

| Euro Pacific (Puerto Rico) | AED 1,800 | AED 110 | 2-3 weeks | USD, EUR, CAD, GBP, CHF, JPY, PLN |

Documents required for opening an offshore bank account with international banks:

The following documents are generally required to open an offshore bank account with an international bank:

- Certificate of incorporation.

- Memorandum and articles of association with amendments if any.

- Board resolution

- Power of attorney (if any)

- Share certificates

- Three (3) months utility bills

- Emirates ID and visa (applicable for the UAE residents)

- UAE entry stamp for non-residents

- Proof of address

- Documents of the authorized signatories, directors, ultimate beneficial owners and shareholders having more than 20% shares in the company, such as:

- Passport

- Proof of residential address

- Utility bills

- Certificate of good standing

- Board resolution authorizing opening of the account and authority to operate the account

The above list is only indicative. Additional documents may be required by specific banks on a case-to-case basis to assess the profile of the client.

We assist RAK offshore companies apply for RAK offshore bank accounts with local UAE and international banks. With dedicated account managers, we guarantee 100% confidentiality. So, if you wish to open a RAK offshore bank account for your company, then do get in touch with us today.

*Monthly charges are only payable when the account balance is less than the minimum balance.

**Estimated time may vary on case-to-case basis.

No Need For A Certificate Of Good Standing For RAK ICC Services

Recently, the Ras Al Khaimah International Corporate Centre released a statement, as per which, the RAK ICC does not require corporate shareholders to furnish a Certificate of Good Standing for the below services:

- Addition / removal of the Nominee Board Member / Trustee.

- Preliminary onboarding of an agent.

- Annual return filing.

- Amendment to the share capital of a company.

- Renewal of a company license.

- Incorporation of a company.

- Transfer of domicile of a company.

However, there is a caveat to this. A Certificate of Good Standing is not required only in cases where the name of the corporate shareholder is displayed on the National Economic Register of UAE. In such cases, the screenshot of the National Economic Register displaying the details of the corporate shareholder must be submitted to RAK ICC, in lieu of a Certificate of Good Standing.

RAK ICC has exempted the submission of the Certificate of Good Standing to facilitate the ease of doing business and to reduce the cost of doing business.

National Economic Register

UAE’s National Economic Register is a centralised registry of UAE consisting of the details of all the companies registered in UAE. The general details of a company found on the National Economic Register would include the name of the company, name of the shareholders, registered address of the company, business activities of the company, among others.

A UAE company on the National Economic Register can be found by entering the below details:

- Company name.

- Company’s license number.

- Company’s CBLS number.

- The business activity of the company.

For further inquiries about RAK ICC company formations, contact InZone today.

How to Open Bank Accounts for UAE Offshore Companies

Opening a bank account is a necessary component of any offshore business setup. It is important to understand the bank’s requirements, follow the correct procedures, and prepare the necessary documentation. If the aforementioned things are not done right, the bank might reject your application for opening the account. Through this article, we aim to simplify all aspects of opening a bank account for offshore companies in the UAE.

Major banks for offshore company accounts in the UAE

The UAE has a well-defined network of local and international banks specializing in offshore banking. Below we have listed some local and international banks that are considered amongst the best to open accounts for offshore companies in the UAE.

Local Banks

- Mashreq Bank

- RAK Bank

- ADCB

- Abu Dhabi Islamic Bank

- Ajman Bank

- Banque Misr

- Dubai Islamic Bank

- Emirates Islamic

- Emirates NBD

- First Abu Dhabi Bank

International Banks

- Bank One (Mauritius)

- Nevis International (St. Kitts and Nevis)

- Caye International (Belize)

- Euro Pacific (Puerto Rico)

- Interpolitan Money (United Kingdom)

- DSBC Bank (Lithuania)

- ABC Bank (Mauritius)

Every bank in the UAE, whether local or international, has its own terms and conditions, timeframes, document requirements, and way of charging fees. You must thoroughly evaluate each of these aspects before opting for a bank. Below we have explained the required documentation and account opening process that is general to almost all local and international banks in the UAE. Depending on the bank you choose, you may be asked for additional documentation and/or follow additional procedures.

Documentation Required for opening a bank account for an offshore company in the UAE

- Passport copies of shareholder(s)

- Emirates ID and visa (applicable for the UAE residents)

- UAE entry stamp for non-residents (for local banks only)

- Certificate of incorporation

- Memorandum of association and Articles of association

- Register of members

- Share certificates

- Board resolution (if any)

- Power of attorney (if any)

- Trade license of home-country business (if applicable)

- Statements of your business account for the last six (6) months (if applicable)

- Statements of your personal account (if you do not have a pre-existing business)

- Recent utility bills (within the last three (3) months)

- Business plan

- Contracts (if available)

- Client invoices (if available)

Process for Setting up Bank Accounts for Offshore Companies in the UAE

- You must file the account opening application with the desired bank. It is recommended to file applications with multiple banks so that you have alternative options in case your application is rejected by one bank.

- An initial verification is conducted by the account manager at the bank.

- You are required to sign the bank documents. In all cases, local banks require your physical presence in the UAE for the signing procedure whereas international banks outside the UAE may permit remote signing.

- The final verification is conducted by the compliance and other relevant departments at the bank.

- Post verification, your application for account opening is either approved or rejected.

- Upon successful approval of your application, you will be required to deposit the minimum balance required by the bank within the specified timeframe.

Maintenance of Bank Accounts for Offshore Companies in the UAE

Once your bank account is successfully opened, you are required to deposit a specified minimum amount in order to activate it. The minimum balance must be maintained throughout. If your account balance is less than the prescribed minimum, you will incur additional monthly maintenance fees. The specified minimum balance and the fee for not maintaining it differ from one bank to another. While the minimum balance ranges from AED 10,000 to AED 100,000, the monthly maintenance charge could be anywhere from AED 50 to AED 500.

Why opt for a Registered Agent to Open Offshore Bank Accounts?

Though the required documents remain more or less the same, the step-by-step procedure and duration to open bank accounts for offshore companies in the UAE differ from one bank to another. While you can always carry out the extensive formalities and open a bank account on your own, there is always a possibility that your efforts will go in vain. It may be simply because the bank you opt for, is not suitable for your requirements or perhaps does not open accounts for your company type.

This is where the need to have professional assistance onboard arises. To open a bank account, your UAE offshore company must be registered in the first place. Offshore company registration in the UAE can be done only through registered agents with offshore jurisdictions. Once this is done, the registered agent will guide you through the entire process of opening the bank account.

Government Departments

We can help you with the processes in the following government departments.

On your

RAK Offshore company

Avail Discount NowBy obtaining the discount, you are agreeing to our terms of use and privacy policy.

Founder's Podcast

Founder's Podcast